Online via GoToWebinar

Why are Biosimilars Failing to Gain Widespread Traction?

Irvine, California

30 years ago, when small-molecule generic drugs first entered the market, they changed the face of healthcare forever. Having a safe and cheaper alternative saved consumers billions of dollars. Biosimilars have a similar potential, so why are they failing to break into the US market?As brand-name biologics begin to age and their patents expire, biosimilar developers grow closer to gaining approval and launching their products. However, they are facing many roadblocks—both regulatory, and marketplace in nature.

In the US, nine patents for the top 20 selling biologics are set to expire by 2020. With the potential for the biosimilar industry to take off, this blog takes a look at why pharmaceutical companies are not as hungry for a slice of the biosimilar-market pie as you might expect.

In the beginning, there was Zarxio.

In March 2015, the FDA approved the first biosimilar through the 351k pathway—Zarxio, a filgrastim biosimilar used to treat low blood neutrophils. So far the FDA has approved 17 biosimilars, but only five, including Zarxio, have been marketed. Others are tied up in patent disputes or waiting for patents to expire.

Around the launch of Zarxio, biosimilars were predicted to disrupt the pharmaceutical market. According to a number of reports, biosimilars and non-original biologics could represent 4-10 percent of a global $250 billion market total by 2020 (equating to $10 – 25 billion).

However, the potential roadblocks for biosimilars to carve out a substantial piece of the global market were acknowledged even then. (Source: Decision Sciences Group) “It is highly unlikely that biosimilars can claim 10 percent of global biologics sales without a strong biosimilars market developing in the US, since the country is the largest biologics market in the world, with the highest per-capita consumption of biologic products.” (IMS Health, 2014)

Roadblocks and hurdles.

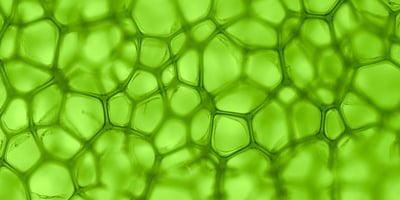

Historically there has been a limited uptake of biosimilars in the US. This can be attributed to the unique nature of biologics drugs—produced from living organisms, manufacturing processes are more important than in the small-molecule drug market.

So what exactly is holding biosimilars back?

1. The slow regulatory process

Lengthy delays and approval processes, along with the hurdles of state substitution laws have seen biosimilars struggle to gain traction. For the FDA to approve biosimilars, the product needs to demonstrate the same safety profile as the original biologic drug. Despite last year’s Supreme Court ruling that biosimilar applicants would no longer have to wait six months to launch their product, these regulatory hurdles are still a setback for manufacturers.

2. A lack of education

For physicians and patients alike, a lack of awareness and understanding around the safety and efficacy of biosimilars has made people hesitate. A systematic approach is now being undertaken by industry representatives to regulate educational information.

3. Competition

Competition is also holding biosimilars back. Originator companies have been launching marketing campaigns to discourage physicians from prescribing biosimilars. These companies are out to defend their patents with everything they’ve got through patent litigation, and the preemptive introduction of obstructive bills in multiple states.

The future of biosimilars.

Part of the reason commercially available biosimilars have failed to gain market share is the nature of biologic drugs themselves. Biosimilars have a complicated validation process, in contrast to small-molecule generic drugs. Biosimilars, as near-identical copies of their originators, generally exhibit high molecular complexity and can be sensitive to subtle changes in manufacturing processes.

Although originator biologic developers are embarking on new strategies to challenge biosimilars and defend their patents, the FDA is trying to clear the regulatory pathway for the approval of biosimilar drugs. It is bolstering efforts to educate physicians to reduce doubts on safety and efficacy.

Further, in cases where a company like Pfizer is battling a company like Johnson & Johnson to release biosimilars, the path less traveled gives an opportunity to corner the market. The future looks complicated for the biosimilar industry, but it is rife with potential.

~

Enterey is a team of high-performing consultants who specialize in the life sciences industry. Our in-depth knowledge of the evolving regulatory landscape in the US and abroad allows us to rapidly diagnose compliance gaps, assess potential quality risks, and develop a foundational quality culture within your organization.

We collaborate with you to:

• ensure clarity of vision

• construct solutions that integrate systems, processes, and behaviors to allow you to better protect your patients

• ensure the reliability of your products, and

• reduce your compliance risk

If you’d like to know more about who we are and what we do, contact our CEO Mike on mike.ferletic@enterey.com

-1.png?width=266&height=69&name=Enterey_Color-Logo-withTag%20(1)-1.png)